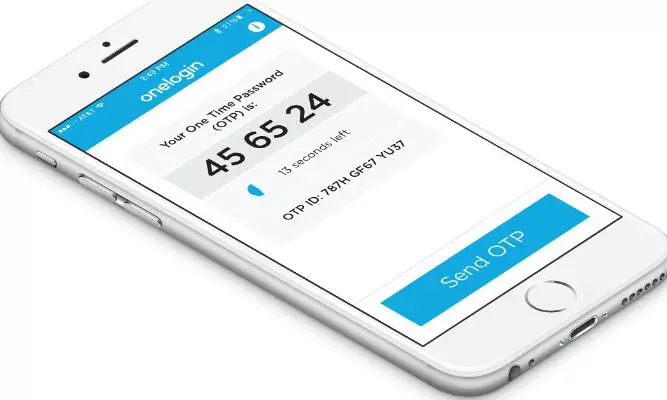

Come November 1, you could face disruptions in receiving bank and delivery of One-Time Passwords (OTPs) due to the new traceability rules of the telecom regulator. The traceability norms effective next month mandate the telecom companies to ensure traceability of all transactional and service messages sent by principal entities such as e-commerce platforms, banks and other financial institutions. They also require telecom companies to block messages with an irregular sending chain, which could disrupt the delivery of OTPs and other important alerts.

These OTPs play a vital role in authorizing online payments and deliveries. The Cellular Operators Association of India (COAI), which includes telecom giants such as Airtel, Vodafone, and Reliance Jio have approached the Telecom Regulatory Authority of India (TRAI) seeking relaxations in the traceability mandate. The telecom operators have warned that messages containing OTPs and other critical details might not reach recipients, as telemarketers and PEs have yet to implement the important technical solutions.

The principal entities have requested an additional two months, during which they could update their systems to avoid interruptions in message delivery. If compliance is granted, this extension could help prevent widespread OTP and transaction messages from disrupting users across the country. However, given that the deadline has been extended several times, it is unlikely that TRAI will grant a further extension.

Initially .