by Geewananda Gunawardana The most relatable definition of being insane is given in the following quote: “doing the same thing over and over and expecting different results.” It has been attributed to the great thinker Albert Einstein, but no definitive proof has been found. Whatever the origin may be, why should it be relatable to us? Because there is every indication that we, as a nation, are on the verge of being the mascot for this famous quote in the way we are heading into the upcoming elections.

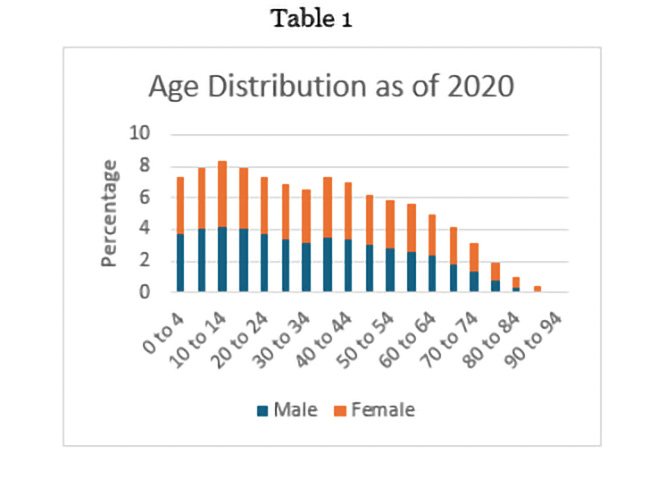

Regardless of the polling data, it can be assured that there is a sizable segment of the voting age population that is committed to proving that they did not learn a thing from their past mistakes. To put this situation in perspective, it is necessary to look at the current demographics of the country (Table 1). There are two key pieces of information: 78 % of the population has become eligible to vote, and it is estimated that a minimum of one million new voters will be casting their votes in this election.

At the same time the median age of the population has reached 33.1 years, the highest in recorded history; for comparison, it was 18.5 years in 1965.

Given the voting age is eighteen, it means that the proportion of young people who have a say in their destiny is much larger today than in 1965. This is a good thing for two reasons: it is this half of the population that will bear the brunt of the consequences of past mistakes and, for that reason alone, they should take a lead in the decision-making process, not the aging population that has let us down. The positive aspect is that based on the events in 2022, it is fair to assume that the young voters have learned from the past mistakes, and they will not let the outmoded and outdated continue the path to ruination.

However, the young alone cannot turn this ship around as they constitute only one fifth of the voting population. Will the remaining four fifths come to their senses or fall for the same old trickery: false promises, divisive rhetoric, and trinkets? Are the would-be saviours of the nation telling us the truth, or are they trying to deceive us once more and continue to plunder the nation’s wealth for the benefit of their own kith and kin? When they bring up divisive issues to get votes, do they realize that the mismanagement of the economy is the root cause of all our problems? Do they have realistic plans to save the country or are they just fairy tales? Can we trust them to keep their promises once in power? Are we sane enough to see fiction from facts? So many questions begging for answers before we go check the box. The year it gained independence, Sri Lanka had a trade surplus of $ 5.

1 million ($65.5 million in today’s money), i.e.

, the value of country’s exports was more than the cost of imports. It fluctuated on the plus side till 1957. From there on it has gone into negative territory, except for the year 1977 when it reported a surplus of $ 60.

5 million. Starting from 1991, the trade deficit had been in billions; and has grown to $ 10.3 billion by 2018, the worst year so far.

Naturally, the country had to take loans to bridge this gap, and by the first quarter of 2024, the government debt has ballooned to an estimated $ 100,184 million (57% domestic, 37% external, and 6% guaranteed loans). One does not need an economic degree to see what has happened. If my living expenses are more than I earn, I have two options: change my lifestyle and reduce the expenses or find an additional income.

On the other hand, if I borrow money to cover the difference, I must make sure that there is a way to pay off the debt, including the principal and the interest. It should be noted that the interest alone can end up being higher than the principle depending on the interest rate and how long it takes to pay off the loan. It is quite legitimate to borrow money to invest in a business or other income generating programms.

If I borrow, I must make sure to invest it in an income generating venture or on a marketable asset. I must also ensure that I will get enough income not only to pay the interest regularly and pay off the loan at a designated date, while supporting the improved lifestyle I desired. Otherwise, I will end up selling whatever assets I have, land, jewelry, etc.

, and end up in a situation worse than before. When it is a country, the assets are the harbours, oil tanks, natural resources, or the right to exploit the innocent. Sounds familiar? There is nothing wrong with borrowing, provided it is done responsibly; in fact, lending and borrowing are essential for economic growth, stability, and efficient resource allocation.

Then the hundred-billion-dollar question is what did the country do with that borrowed money? Was the money borrowed by Sri Lanka spent on failed or poorly managed businesses, spent on non-income generating luxuries, or stolen? Since year 1960, the country’s gross national product rate had stagnated around 4.2%. This means two things, obviously the borrowed money was not invested in improving the GDP at the desired rate.

If money was borrowed at interest rates higher than 4.2%, then there is no way we could have afforded to pay off the debt. During the first two to three decades after independence, there had been a concerted effort to increase the manufacture of essential commodities and consumer goods locally.

A large number of state-owned enterprises were started, and policies that supported local industries were put in place. Not only essentials such as sugar, flour, and dairy products but also radios and cars were produced locally. Thanks to these efforts, the borrowing as a percentage of GDP was reduced and a trade surplus was reported for the years 1961 – 1963, and in 1977 (Table 2).

Those interested in pragmatic economic policy should examine the policies in place that led to these two events that have become anomalies in Sri Lankan economic history. If such policies were allowed to continue, would the country be in a different place is anyone’s guess. Sadly, those who were instrumental in such visionary policies are no longer with us.

The country has not been able to recover from the dramatic downturn of the regressive trend started in 1977; pandits have analysed the minutia of the policy and politics that resulted in this downfall of both economic and social conditions. The state-owned enterprises have become hunting grounds of political cronies and are draining the nation’s coffers instead of adding to it. So do some of the infrastructure projects.

However, the luxuries available to some have created the illusion of a flourishing economy despite the human tragedy unfolding behind that façade. The mantra is that being poor is bad karma, and economic policies and mismanagement have nothing to do with it: join the bandits! The working people of the country have done their part to keep the GDP moving in the right direction despite enormous obstacles. But has their lot improved over the years? One can argue both ways.

Sri Lanka’s quality of life had been higher than most other Asian neighbours; if that is the case, did we spend our borrowed money to improve our living equitably? People have more radios, phones, and refrigerators than they did in the sixties, but the disparity between haves and have nots has got worse over the same period. The so-called free education and free healthcare have become a mockery. On top of that, 37 % of tax money is used to bail out failing state own enterprises.

That is equivalent to about Rs. 34,000 per person a year. They may have more cell phones and TVs than ever, but if the quality-of-life of Sri Lankans have improved is another question.

Do they reap the benefits of their hard work or have their purchasing power improved are other ways to look at it? Several indices used to measure it say no. The Gini index has gone from 3.9 to 5.

1 over the last three decades. Gini is an indication of the income distribution: a value of zero means perfect income distribution while ten means complete polarization. According to the UNDP Regional Human Development Report – 2023, the richest one percent of Sri Lankans own 31 percent of the total personal wealth, while the bottom 50 percent only owns less than 4 percent of the overall wealth in the country.

In simple terms, the rich got richer, and the poor got poorer. The middle class has shrunk: the poverty rate has gone from 11% to 26%. According to a survey, the happiest country in the world scored 7.

7 while the unhappiest country scored 1.7 in the scale used; that is assuming happiness can be quantified. Sri Lanka scored 3.

9; no wonder that those who can are fleeing. While the bottom fifty percent is struggling to have one meal a day, skip medications and treatment, pawn their possessions to pay for education, and suffer and get humiliated in public transport, there is a class that feast on imported top notch food and drinks, go to Singapore for medical treatment, send their kids to private or overseas institutions, and drive the most luxurious vehicles available. Did they earn such wealth by legitimate means? Was it at the expense of the wretched housemaids in the mid-East or the near starving working people? Was the borrowed money stolen? There is no argument that all this is the fault of those who governed the country during this steady decline, and the bureaucrats that aided and abated their misdeeds.

The most important thing for the people to decide at this critical juncture is to identify the people who committed this crime against the country and do everything possible to stop them from ever again coming into power. With the habitual crossing of party lines and forming dubious coalitions, which is done solely for the proverbial saving their own skin, it has become increasingly difficult to identify those culprits. That is why remembering past politics is so important.

Whether the socialist or capitalist policies are suitable for Sri Lanka is a major deciding factor for some. It is true that the socialist system has failed. On the other hand, the capitalist system is not without its problems.

For example, in 2023, the US debt to GDP ratio was 123%; that is not sustainable, and it will burst someday. What is more, whatever you call it, the Sri Lankan system has not worked either. Sri Lanka must find its own economic policy to suit its own conditions.

They will say that China is a communist country, but they fail to recognise that it has a socialist market economy. As of July 2024, China has the second-largest economy in the world by nominal GDP, behind the United States. In 2024, China’s GDP was around $18.

5 trillion, compared to the US’s GDP of almost $29 trillion. However, when measured by purchasing power parity (PPP), which accounts for price level differences between countries, China’s GDP has been larger than that of the US since 2016. Do our politicians and bureaucrats have the wisdom to find out what works for us rather than clinging to extremes and pointing fingers at the other? Isn’t our culture supposed to be shaped by the Middle Path? The data provided in Table 2 has a wealth of information relevant to this topic.

If one examines when the ups and downs of the two indices took place, it is not difficult to identify what policies could have worked if allowed to continue. That will also show who plundered the wealth, exploited the hard-working people, and pawned the nation’s future. The immediate task at hand for the voters is to stop the culprits of the ruination and their henchmen from returning to power.

If we do not select the right path, it is the younger generation that will end up paying for the crimes committed by their elders for decades. This is our rightful opportunity to bring about the changes we demand and deserve; it is our civic duty. If we neglect that sacred obligation to the country, we the voters will be as complicit as the wrong doers.

The choices may be limited, and the options may not be perfect. Beggars cannot be choosers, and our situation is diabolical. One thing is certain, giving power to the same corrupt lot again is nothing but insanity.

.