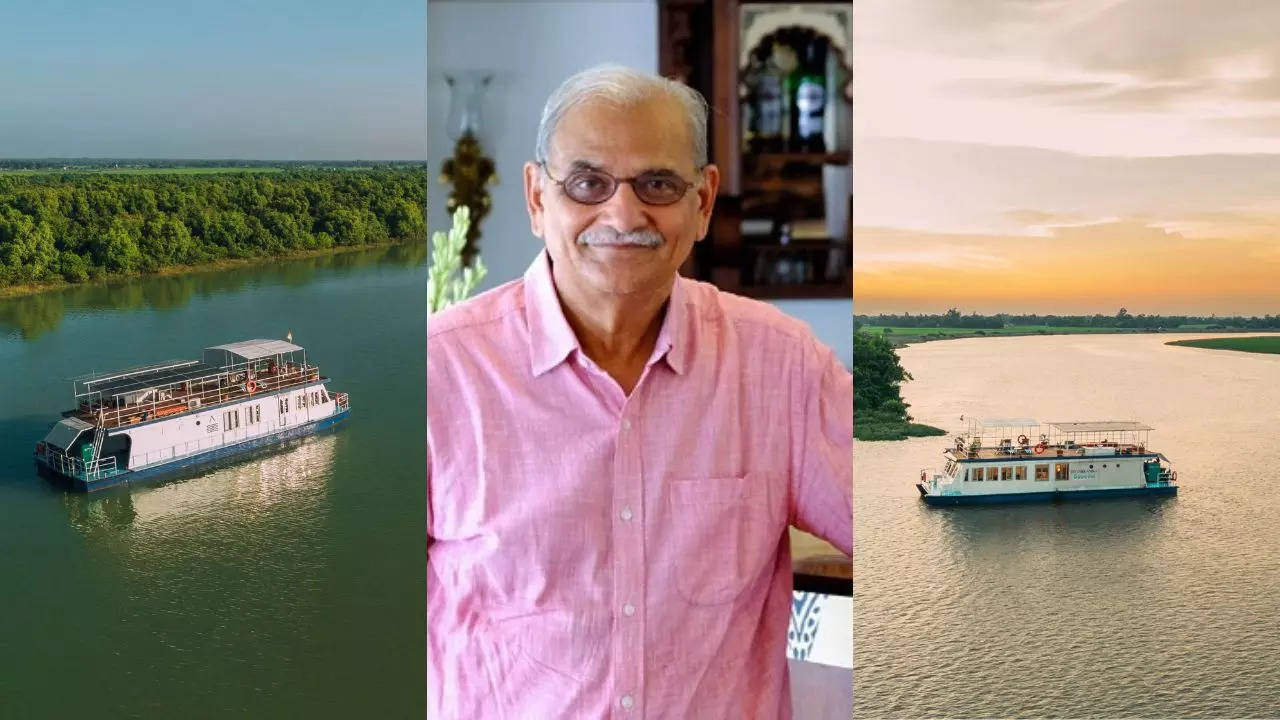

SINGAPORE: The middle class, often seen as the backbone of society, faces numerous financial challenges that can hinder their ability to move up and achieve financial freedom. These challenges are often rooted in common money mistakes that, if avoided, could significantly improve their financial future. Succumbing to societal pressure Living beyond one’s means due to societal pressure to appear wealthy can be another financial pitfall.

This is the proverbial “keeping up with the Joneses” mindset. This often leads to overspending on status symbols and luxury items , quickly depleting savings and preventing financial progress. Considering loans as free money is a dangerous financial trap.

While loans can be necessary, treating them as a regular source of income can lead to a cycle of debt that is difficult to break, further straining financial health. Failing to save for retirement is a critical mistake. The middle class often prioritizes immediate expenses over long-term financial goals, leaving them unprepared for retirement and dependent on government assistance or family support.

One of the most prevalent mistakes is the absence of a strict budget. Without a budget, it’s easy to overspend and fail to save for the future. This oversight can lead to financial instability and prevent the middle class from building wealth over time.

Poor investment choices Making poor investment decisions can also be a significant setback. Investing in assets that do not appreciate or c.