Pune, July 13, 2024 (GLOBE NEWSWIRE) -- A rapidly growing healthcare infrastructure, driven by government spending on modernizing hospitals and research facilities is further boosting demand for precise medical billing leading to a propulsion in the medical coding market. Add in the digitization of medical records and billing, a process that demands coders with increasingly intricate levels of skill to be able to navigate this new world. Another significant factor is an increasing aging population and the associated increased hospital admissions (up 34m in US alone by 2024).

Coding and billing providers must be able to manage this growing complexity with efficient solutions in order to meet the demands of the market. Such factors are set to persist with the Bureau of Labor Statistics anticipating an 8% growth from now until 2032 in medical records and health information technician positions, further emphasizing the indispensable nature that orthopedic surgery coding must play within a fast-paced healthcare world growing at breakneck speed. Moreover, just ensuring standardized documentation across healthcare facilities, medical coding offers valuable insights for administrators.

It allows them to analyze the effectiveness and frequency of treatments, a crucial task for large institutions. Advancements in coding software are further enhancing this capability. For instance, Amazon Web Services launched an AI-powered service that generates clinical documentation automatically, streamlining the coding process.

Capitalizing on this growth, major players are introducing innovative solutions. CorroHealth's PULSE platform automates coding and expedites revenue recovery for healthcare organizations. Additionally, companies like CodaMetrix are securing funding to develop AI-powered solutions for autonomous medical coding, signifying a growing trend in investment for medical billing and coding software.

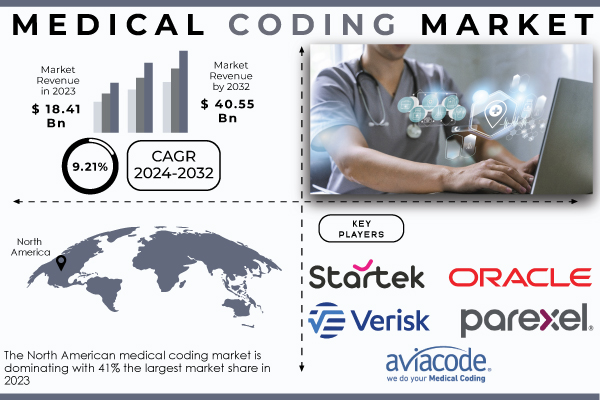

The key players are Oracle Corporation, Startek Health, Parexel International Corporation, Verisk Analytics, Maxim Health Information Services, Aviacode, Inc., GeBBS Healthcare, Precyse Solutions, LLC, 3M, AGS Health, Dolbey Systems Inc., Medical Record Associates LLC, MRA Health Information Services, Semantic Health, Optum Inc.

, Nuance Communications Inc., The Coding Network LLC, Talix and others players Despite challenges like regulatory changes and data security, the overall outlook for the medical coding market appears bright. The demand for efficient and cost-effective billing procedures, particularly for faster turnaround times, is driving growth across hospitals, standalone diagnostic centers, and physician clinics.

As healthcare institutions seek to improve patient satisfaction, leveraging the power of medical coding expertise is becoming increasingly crucial. Based on the classification system, HCPCS dominated the medical coding market in 2023 due to its dual billing and clinical uses, the future is ripe for AI integration. ICD and CPT, crucial for accurate diagnoses and physician billing, are poised for faster growth.

The emergence of certifications like CAIMC highlights this trend – coders equipped with AI tools can significantly improve coding accuracy and efficiency, making ICD and CPT the fastest-growing segment in future years. Based on components, Outsourcing is the dominating segment in 2023 with 56.33% market share, offering healthcare organizations cost-effectiveness, access to specialized coders, and easy scaling.

However, in-house coding is the fastest-growing segment. Here, healthcare providers train their staff, gaining control over data security, fostering direct communication with providers for clarification, and allowing for customization to their specific needs.Based on end users, it includes hospitals, diagnostic centers, and other segments.

medical coding market holds the largest market share and shows no signs of slowing down. This leadership is fuelled by several key factors such as A wave of investments is transforming healthcare infrastructure across North America. Governments are actively involved, fostering the establishment of healthcare digitization organizations and the development of cutting-edge technologies for diagnosis, treatment, billing, and record management.

The integration of standardized coding systems like HCPCS, CPT, and ICD-10 CM is gaining traction. This ensures clear and consistent communication between healthcare professionals when categorizing patient services, ultimately leading to a more accurate reflection of the services rendered. Chronic illnesses like cancer are on the rise, fueling the demand for medical coding.

In the US, lung cancer diagnoses are expected to jump from 1.9 million in 2023 to a staggering 2 million in 2024 (American Cancer Society). This surge translates to more patients needing hospitalization and, consequently, more complex medical data to manage.

As healthcare keeps changing, North America is in a prime position to lead the way by adopting new technologies and adapting to the evolving needs of the medical field. 1. Introduction 2.

Industry Flowchart 3. Research Methodology 4. Market Dynamics 4.

1 Drivers 4.2 Restraints 4.3 Opportunities 4.

4 Challenges 5. Porter’s 5 Forces Model 6. Pest Analysis 7.

Medical Coding Market Segmentation, By Classification System 8. Medical Coding Market Segmentation, By Component 9. Medical Coding Market Segmentation, By End-user 10.

Regional Analysis 11. Company Profiles 12. Competitive Landscape 12.

1 Competitive Benchmarking 12.2 Market Share Analysis 12.3 Recent Developments 12.

3.1 Industry News 12.3.

2 Company News 12.3.3 Mergers & Acquisitions 13.

Use Case and Best Practices 14. Conclusion is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances.

In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world..