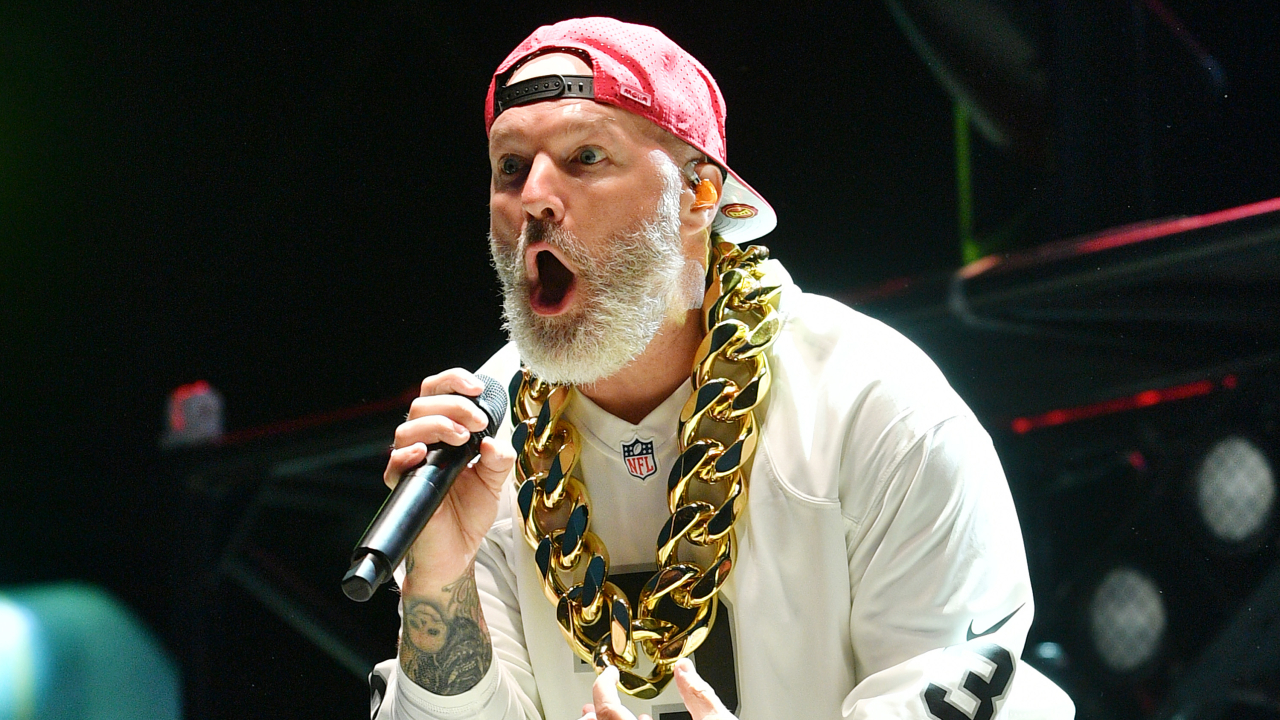

Our community members are treated to special offers, promotions and adverts from us and our partners. You can check out at any time. More info Martin Lewis, the well-known money saving expert, has delivered a stark warning to Britons harbouring savings, indicating they could be slapped with a significant tax demand.

Specifically spotlighting individuals with £10,000 put away, Lewis highlighted that they might find themselves owing cash to the taxman due to current interest rates offered by banks. On air during The Martin Lewis Money Show Live on ITV, he pointed out that the landscape for taxation on savings "really has changed very much" in recent years. This is due to the fact that savings account interest rates have rise from around one percent to approximately five percent.

While this boost seemingly benefits savers, it also acts as a double-edged sword, increasing the number of people whose savings interest is susceptible to tax. As reported by Express.co.

uk , Lewis detailed that a basic rate taxpayer in with £20,000 in savings may find themselves owing tax within a 12 months. Furthermore, a higher rate taxpayer, an individual pocketing £50,270 annually, could be liable to pay tax with just £10,000 in savings. “So look, savings tax is back for many,” he said.

“When you get interest on your savings, it is eligible for income tax. It counts as income.” Luckily most people can earn up to £1,000 a year interest without needing to pay tax.

He continued: “But you.