Pune: Hours before the code of conduct for the Nov 20 assembly polls came into effect on Tuesday, state govt issued an order directing PMC to pause collection of property tax in the city's 32 merged areas . Govt said Pune Municipal Corporation (PMC) can resume charging the property owners in the added areas after sending them revised bills, fixing the tax at double the amount that was levied by the respective gram panchayats before the merger. The order reached PMC late Tuesday night.

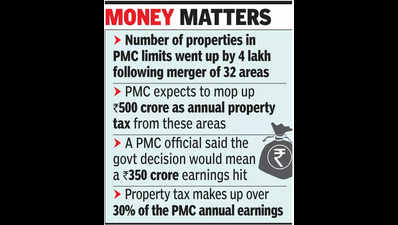

Sources said the tax may increase in future after PMC ensures that the merged areas get water and other civic amenities like other parts of the city. Though the tax relief will benefit residents of the 32 merged areas, the decision will affect PMC's income. Property tax makes up over 30% of the PMC annual earnings.

The number of properties in PMC limits went up by 4 lakh following the merger of the 32 areas. Based on the PMC's standard calculation, the civic administration expects to mop up Rs 500 crore as annual property tax from these areas, an official said. PMC was expecting Rs 150 crore as property tax from the 11 areas, merged into it in 2017, and around Rs 350 crore from the 23 localities subsequently added.

The official said deviation from the standard calculation would mean a Rs 350 crore earnings hit. PMC records showed that the civic areas had around 8.5 lakh properties prior to 2017.

After the merger of 11 villages, the number went up to around 10 lakh. Nearly 2 lakh properties were .