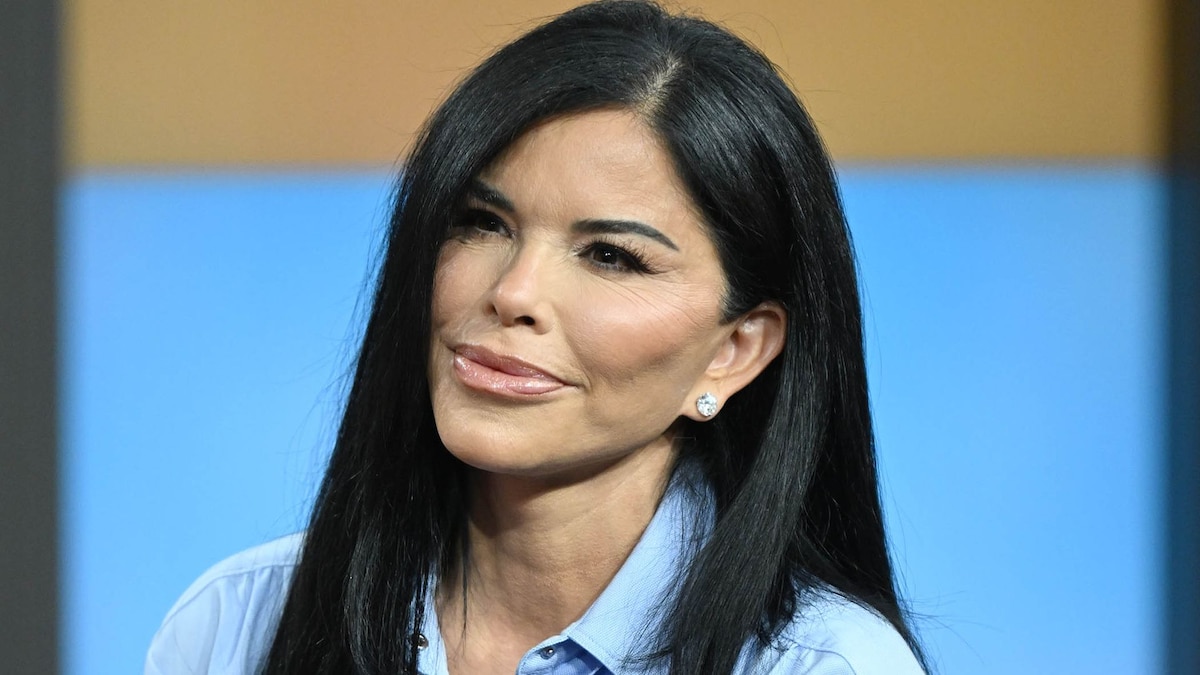

Florida is the world-famous home to hundreds of miles of beautiful beaches and thus welcomes more than 140 million tourists each year. However, if you’re in the market to buy property in the Sunshine State, be forewarned of which cities to avoid. Real estate expert Yawar Charlie , director of Aaron Kirman Group’s estates division and a cast member of CNBC’s “ Listing Impossible ” warns in a recent interview : “When it comes to real estate, not every sunny spot in the Sunshine State is a wise investment.

“Investing in real estate is about more than just sunshine and palm trees. It’s crucial to look at economic stability, growth potential, and environmental risks. Before you get swept up by the allure of Florida’s warm weather, make sure you’re also considering the financial forecast.

” Charlie breaks down the five worst cities in Florida to refrain from buying in the next five years and his reason why: 1. Miami Beach: Despite the allure of Miami Beach’s nightlife and world-class dining, Charlie warns: “Yes, Miami Beach is glamorous, but the rising sea levels and increasing frequency of hurricanes pose significant risks. The cost of insuring properties is soaring, and the potential for long-term value depreciation is real.

It’s like buying a beautiful beachfront home with a ticking time bomb in the basement.” 2. Daytona Beach: Charlie warns not to be too blinded by beaches to not see the downsides, saying: “While it may be famous for its speedway, Daytona Beach struggles with economic stagnation and high crime rates.

The real estate market has been sluggish, and without major economic development, property values are likely to remain flat. Investing here might leave you feeling stuck in the pit stop.” 3.

Fort Meyers: “Despite its appeal to retirees, Fort Myers faces issues with overdevelopment and environmental concerns, particularly regarding water quality,” Charlie warns about this favorite spot for retirees. “The housing market has been volatile, and long-term growth prospects are uncertain. It’s a bit like buying a flashy car that might just run out of gas.

” 4. Pensacola: Charlie warns that Pensacola has been impacted by a sluggish economy, saying: “This city has faced economic challenges and limited job growth, which impacts the housing market. High crime rates and a lack of new development projects make it less appealing to investors.

” 5. Ocala: Similar to Pensacola, Ocala has suffered from limited amenities and a sluggish economy. “While affordable, Ocala’s real estate market is hindered by slow economic growth and limited amenities,” said Charlie.

“The area is heavily reliant on agriculture, which can be volatile. Think of it as putting your money into a time capsule with no guarantee of future rewards.”.