The red flags that were missed or dismissed when Harrods was bought Getty Images In 2010 the Gulf state of Qatar bought luxury department store Harrods for £1.5bn, via its sovereign wealth fund, the Qatar Investment Authority. It should have been the jewel in the Qatari crown.

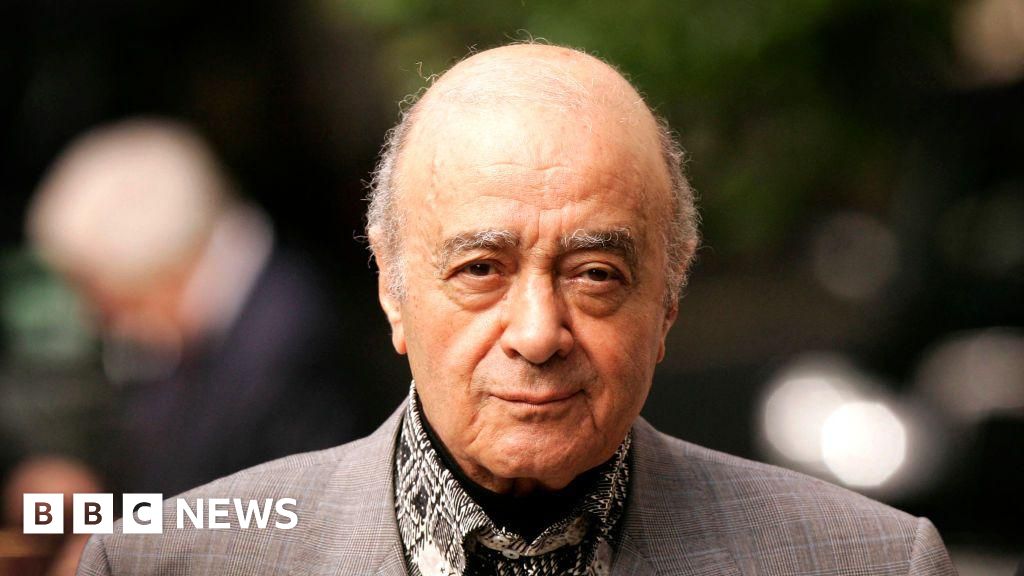

However, Harrods now faces serious sexual abuse allegations over the actions of its former boss, Mohamed Al Fayed. Many of these claims were uncovered in a recent BBC investigation, but multiple legal experts have said Qatar either missed or dismissed much of what was already known about Al Fayed at the time of the purchase. This includes a 2008 police investigation into the alleged assault of a 15-year-old girl in a Harrods boardroom.

Harrods has told the BBC it is "utterly appalled" by the allegations and has apologised to the victims. It now looks as if the scandal could cost the company and its owner millions. So what, if anything, was known by Qatar about the allegations? 'Inadequate' due diligence When a company buys another company, the process of looking to see if there are any skeletons in the cupboard is known as due diligence.

The buyers will hire advisers who will ask the seller's advisers questions about any issues they should know about. They may also do their own independent research. When the owner is someone like Mohamed Al Fayed, who had several allegations surrounding him at the time of the deal, the buyer's due diligence process should be lengthy.

"I think it would be sensible to as.