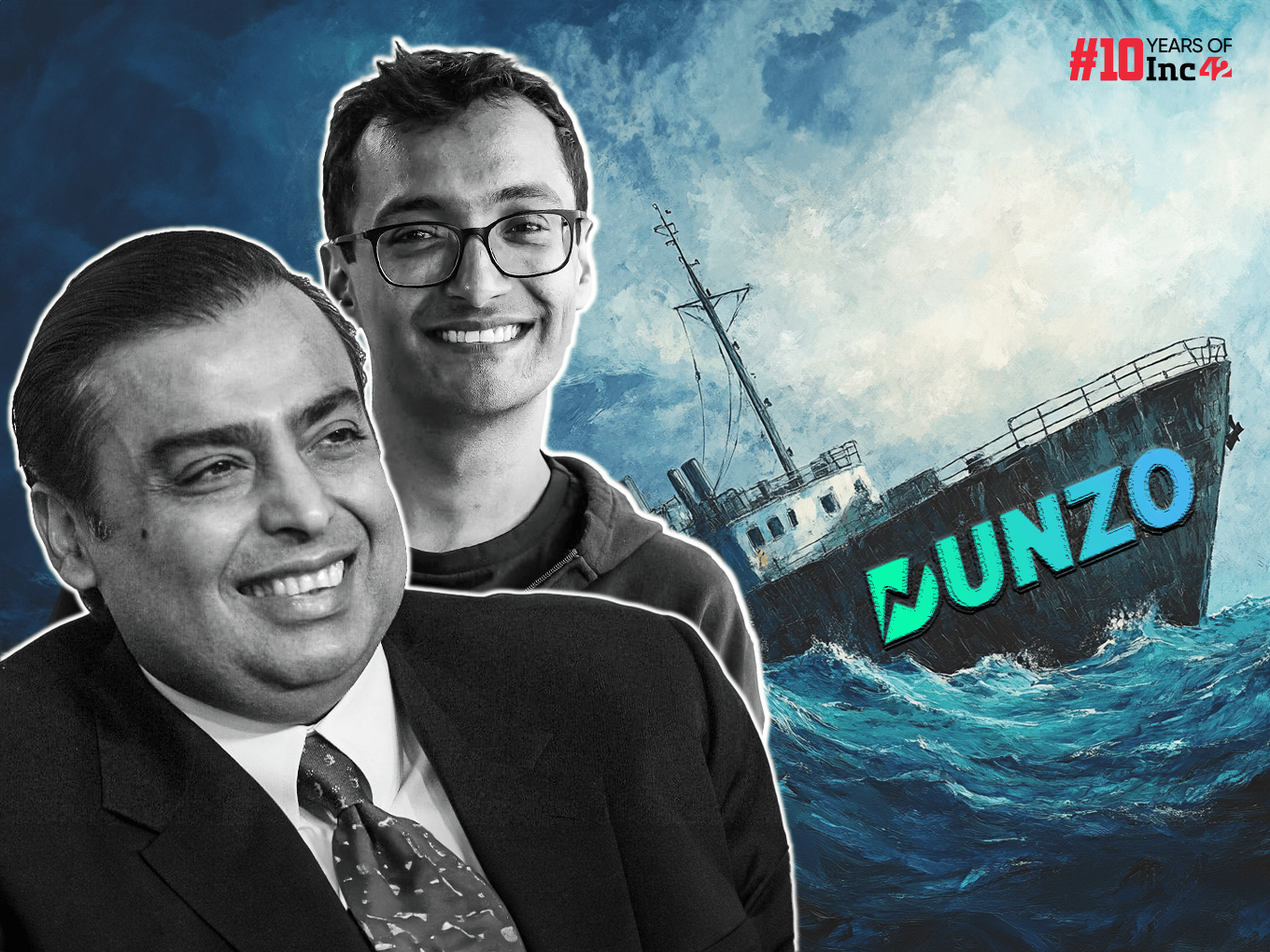

Dunzo cofounder and CEO Kabeer Biswas as per our sources is leading talks with high net worth individuals and family offices for an acquisition deal Reliance is also now involved in any talks to infuse funds into Dunzo or acquiring it in a distress sale after the company’s cash crunch and retreat from quick commerce in the past 24 months CEO Biswas is reportedly close to quitting the company and has communicated his decision to investors Reliance Retail, the largest shareholder in troubled hyperlocal startup Dunzo, has written off its $200 Mn investment in the company, multiple sources privy to developments told Inc42. Reliance is also not involved in any talks to infuse funds into Dunzo or acquiring it in a distress sale after the company’s cash crunch and retreat from quick commerce in the past 24 months. Meanwhile, Dunzo cofounder and CEO Kabeer Biswas according to our sources is leading talks with high net worth individuals and family offices for an acquisition deal that would value the startup at INR 300 Cr ($25 Mn-$30 Mn).

“Reliance has assured Biswas that they will be supporting him to salvage Dunzo. But they are not interested in buying Dunzo. They had made a buyout offer 2-3 years ago offering to buy the hyperlocal startup at a near unicorn valuation, which Biswas declined.

But after quick commerce startups entered the industry and Dunzo’s inability to scale beyond a few cities, Reliance had absolutely no interest in Dunzo,” one of the sources quoted above .