Klaus Vedfelt/DigitalVision via Getty Images Synopsis Coty Inc. ( NYSE: COTY ) is one of the largest beauty companies in the world and owns a portfolio of renowned brands. COTY’s historical financials have demonstrated strong top-line growth.

Additionally, its profitability margins over the same period expanded annually as well. For its most recent quarter, it continues to report net revenue growth driven by growth in both of its reportable segments. Currently, both prestige and mass beauty channels have been growing strongly, with prestige reporting higher year-over-year growth.

COTY has been focused on accelerating its prestige division in order to capture this growth. Therefore, this initiative to expand on high-growth prestige products is expected to capture market share and drive growth. Apart from growing its top line, COTY is also committed to reducing its debt levels.

By 2025, it is expected that leverage will be reduced to approximately 2x through EBITDA expansion. In addition, its 2025 free cash flow is expected to grow as well. Overall, I am recommending a buy rating for COTY.

Historical Financial Analysis Author's Chart Over the last three years, COTY’s top line has shown consistent growth. In 2021 , its reported net revenue was approximately $4.63 billion.

In 2022 , net revenue grew to $5.3 billion. 2022’s strong growth was attributed to store reopening and an increase in leisure travel as a result of loosened COVID restrictions.

Both its prestige and consumer beauty segments benefited from increased foot traffic and demand, with the prestige segment benefiting the most. In 2023 , COTY’s net revenue continued to increase. It reported net revenue of $5.

55 billion, driven by growth in both of its segments. The consumer beauty segment’s growth was attributed to strong performance in the body care, skincare, and cosmetics categories. For the prestige segment, it was driven by strong performance in the fragrance category due to the success of its brands such as Burberry, Calvin Klein, Hugo Boss, Gucci, and Marc Jacobs.

Author's Chart Regarding profit margins, both its adjusted EBITDA margin and adjusted net income margin performed well over the last three years. Its adjusted EBITDA margin expanded from 2021’s 16.5% to 17.

1% in 2022. In 2023, it expanded to 17.5%.

The margin expansion in 2023 was driven by a decrease in fixed costs as a percentage of net revenue, as well as a decrease in advertising and consumer promotional costs as a percentage of net revenues. Additionally, its 2023 adjusted net income margin attributable to COTY increased from 4.4% to 8.

2%. This strong expansion is driven by improvements in its underlying net income. The net income improvement is driven by higher operating income.

Business Overview Being one of the largest beauty companies in the world, COTY has an extensive line of iconic brands, from fragrances and cosmetics to skin and body care. Its iconic portfolio can be segregated into prestige brands and consumer beauty brands. Prestige brands include Burberry, Kylie Jenner, Davidoff, Hugo Boss, and others, while its consumer beauty brands consist of Adidas, Beckham, Sally Hansen, and plenty more.

COTY has sold a 60% stake in Coty’s Professional and Retail Hair business, which includes the Wella business, in FY2021. As of 2023 , prestige brands account for approximately 60% of net revenue, while consumer beauty accounts for the remaining 40%. Its prestige fragrances are growing double-digit globally, especially with brands under Burberry, Marc Jacobs, and Kylie Jenner.

Author's Chart Third Quarter 2024 Results Analysis In 3Q24 , COTY’s net revenue increased 8% year-over-year to $1.38 billion. Both its revenue segments grew in the quarter.

Its prestige segment net revenue increased by 8%, while consumer beauty increased by 6%. For its prestige segment, the growth was driven by positive pricing impact and volume growth. For its consumer beauty segment, the net revenue growth was also driven by increased volume and a positive price impact.

Moving on to margins, COTY’s gross profit margin expanded from 62.9% to 64.8%.

This improvement was attributed to premiumization, supply chain productivity savings, and lower inflation. As a result of higher sales and gross profit, COTY’s adjusted EBITDA for the quarter increased 10%. Its adjusted EBITDA margin expanded from 14.

1% to 14.4%. On the other hand, its adjusted net income margin decreased from 13% to 3.

2%. However, the decrease was due to last year's benefit from the mark-to-market on the equity swap. 3Q24’s adjusted EPS reported was $0.

05 and note that this EPS includes a $0.01 negative impact from the mark-to-market equity swap. For context, the previous period’s adjusted EPS was $0.

19, but it included a benefit from the mark-to-market on the equity swap of $0.13. If we net out the impact of the equity swap, adjusted EPS was in line year-over-year.

High-Growth Prestige Beauty Market Prestige and mass beauty have been growing strongly over the past year. The US prestige beauty industry dollar sales reported double-digit growth, up 14% year-over-year, while mass beauty increased by 6% year-over-year. The prestige beauty industry remains robust as consumers are willing to pamper themselves with little luxuries, driving premiumization trends.

Such a trend towards prestige beauty brands is the main driver of the industry. Prestige makeup shows the strongest growth in this industry, with lip makeup outperforming the rest, growing at twice the rate of the overall category. Prestige fragrance also grew by approximately 12% year-over-year.

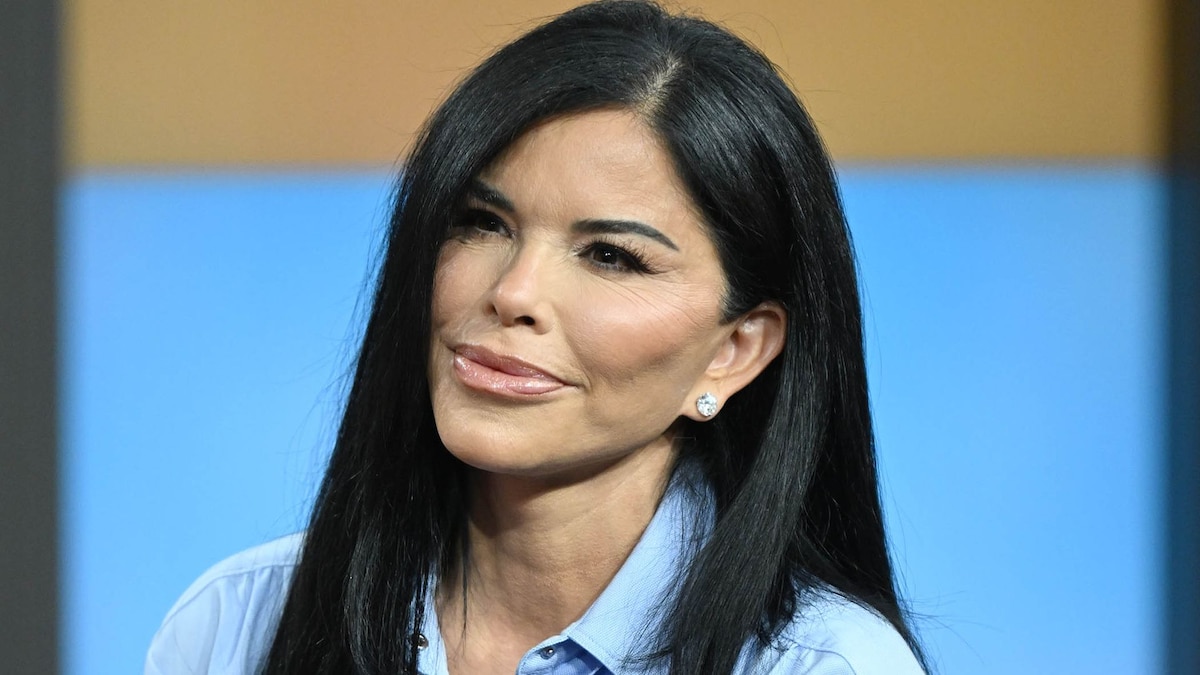

Circana To capture this high-growth market, Sue Nabi has been focused on accelerating COTY’s prestige division by expanding into prestige cosmetics and building a comprehensive portfolio. COTY’s strategic partnership with Kylie Jenner and Kim Kardashian adds a level of prestige and aspirational value to COTY’s product offering. This would drive growth by leveraging the influence of digital-native celebrities, bringing in new customers, and enhancing its equity value.

Its initiative to expand on the high-growth prestige products is expected to capture market share and drive growth. Investor Relations Deleveraging On Track Investor Relations COTY has been highlighting their focus on reducing net debt and taking actions to improve leverage ratio. Since 2021, its leverage ratio has been improving from approximately 6.

8x to approximately 3x in 2023. COTY’s retained 25.8% stake in Wella is valued at around $1.

08 billion, its leverage ratio would be approximately 2x if we were to factor in the sales of the Wella stake. Ending with a net debt of approximately $3.7 billion in 3Q24 , COTY ended the quarter with a leverage ratio of approximately 3.

4x. It is committed to achieving approximately 2.5x leverage ratio upon exiting calendar year 2024 and approximately 2x in 2025 through EBITDA expansion.

Regarding its 2024 free cash flow generation, free cash flow is forecast to be consistent with 2023 of approximately $400 million, as strong profit expansion is offset by an increase in cash tax payments related to prior years and higher working capital. On a brighter note, free cash flow is expected to grow in 2025. In addition, the firm has set its eyes on continuing the divestiture of its Wella stake by 2025.

Relative Valuation Model Author's Relative Valuation Model In my relative valuation model, I will be comparing COTY against its peers in terms of growth outlook and profitability margins trailing twelve months [TTM]. For growth outlook, I will be comparing their forward revenue growth rate, as it is a forward-looking metric. For net income margin TTM, I will be comparing their EBITDA margin TTM and net income margin TTM, both of which will give us a deeper insight into the strength and performance of their core business activities.

For growth outlook, COTY outperformed its peers. COTY’s forward revenue growth rate of 7.02% is higher than its peers’ median of 2.

52%. In terms of profitability margins, COTY’s performance against its peers is mixed. For EBITDA margin TTM, COTY reported 18.

03%, which is higher than its peers’ median of 14.67%. However, in terms of net income TTM, COTY reported 3.

59%, lower than its peers’ median of 10.21%. Currently, COTY’s forward non-GAAP P/E ratio is 22.

47x, slightly above its peers’ median of 22.41x. Given COTY’s mixed performance against its peers and weaker net income margin TTM, I argue that its P/E should not be above its peers’ median.

Therefore, I will be adjusting my 2025 target P/E for COTY downward by applying a small discount on peers’ median P/E. For 2024, the market revenue estimate for COTY is approximately $6.13 billion, while EPS is $0.

44. For 2025, the market revenue estimate is approximately $6.5 billion, while EPS is $0.

58. When analysing its 3Q24 earnings results, COTY did provide its guidance for FY2024. COTY guided FY2024 LFL revenue growth to be between 9% and 11%.

In terms of adjusted EBITDA margin, COTY forecasts an expansion of between 0.1% and 0.3%.

Lastly, adjusted EPS is expected to be between $0.44 and $0.47.

Taken together, the management guidance and my forward-looking analysis support and justify the market’s estimates. Therefore, by applying my 2025 target P/E to its 2025 EPS estimate, my 2025 target share price is approximately $11.70.

Risk and Conclusion Over the last few years, the US and Western Europe’s retail industries have undergone significant consolidation. As a result, fewer key retailers control more retail locations, and this caused COTY to be more reliant on them. Additionally, an increase in the popularity of online shopping and a decrease in in-store traffic resulted in the closure of brick-and-mortar stores.

This situation might hurt COTY if these retailers decide to cut back on COTY’s products or if they decide to give more shelf space to competitors. To give an example, COTY’s CoverGirl brand has already lost shelf space. Over the last three years, COTY’s net revenue has been consistently growing, driven by growth in both of its revenue segments.

In addition, its profitability margin has been consistently expanding as well. Both the US prestige beauty and mass market beauty channels reported year-over-year growth when compared against 2022. Taking a deeper look, the prestige channel reported higher growth than the mass market.

In order to capture growth from this trend, COTY has been focusing on accelerating its prestige division by expanding into prestige cosmetics and building a comprehensive portfolio. This strategic initiative is expected to capture market share and drive growth. Apart from growth initiatives, COTY is also committed to reducing its debt levels.

By 2025, COTY is targeting a leverage ratio of approximately 2x. In addition, its free cash flow is forecast to grow in that year as well. Overall, I am recommending a buy rating for COTY.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha).

I have no business relationship with any company whose stock is mentioned in this article. Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor.

Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

.