As political uncertainty drives their prices down...

Look to Europe for some star performers By Anne Ashworth Updated: 22:05, 12 July 2024 e-mail View comments France should be in a state of high excitement ahead of the start of the Paris Olympics later this month. Instead, the nation is in a state of turmoil following a deadlocked election. There are fears of a market rout if the far-Left, which gained most votes in last weekend's poll, forms a government and announces large spending plans – as public finances are already perilously stretched.

A hung Parliament, without a clear agenda, would also be hazardous to investor confidence. These outcomes would also send tremors through the rest of the eurozone, thanks to the bloc's currency and fiscal links. Jamie Ross, joint manager of the Henderson European Trust, comments: 'Political uncertainty in France is political uncertainty at the heart of the EU.

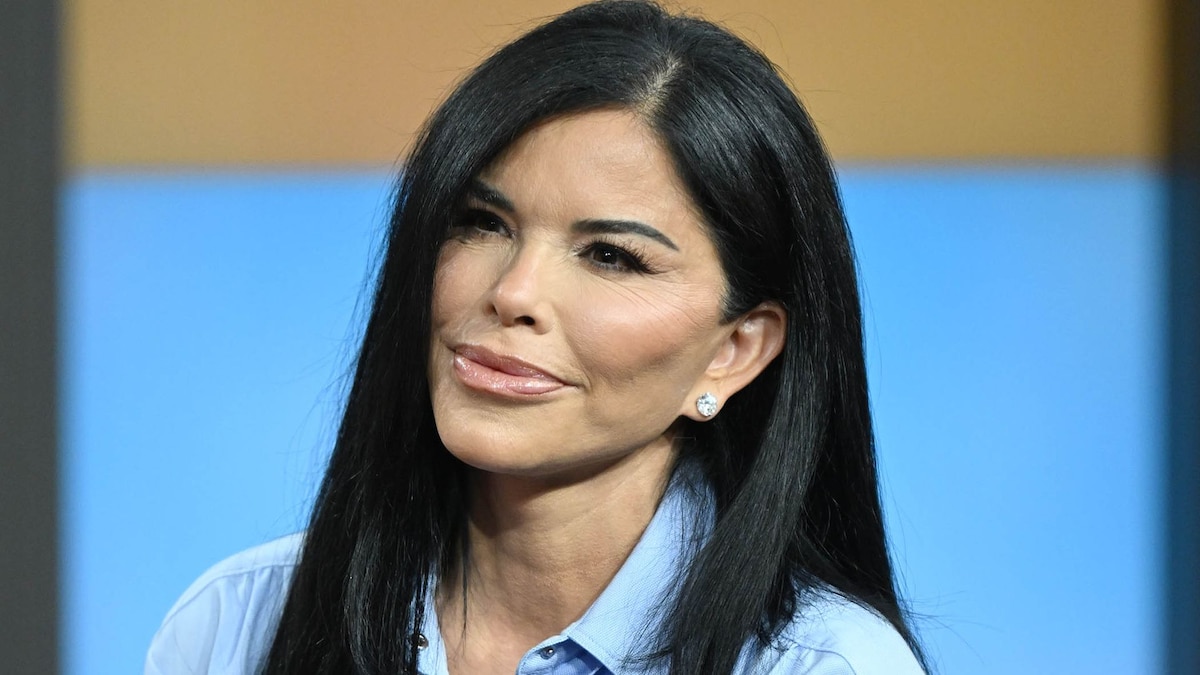

' The right specs: Essilor Luxottica is the worldwide leader in the sunglasses sector So what does this mean for Europe's pharmaceutical, software and other companies, which are seen as the nearest thing to America's 'Magnificent Seven' tech stocks? Earlier this year, US banks extolled the virtues of these businesses. Citi tipped its 'Super Seven' – ASML, Ferrari, LVMH, Novo Nordisk, Richemont, Schneider Electric, and SAP. Goldman Sachs recommended 'the Granolas' – GlaxoSmithKline (GSK), Roche, ASML, Nestle, Novartis, Novo Nordisk, L'Oreal, LVMH, AstraZeneca, SAP and Sanofi.

This actually spells out 'Grannnolass' and includes two UK names, GSK and AstraZeneca. But Goldman describes them as 'internationally-exposed quality growth compounders', suggesting that they have the 'je ne sais quoi' to transcend upheaval. If you want to take a European flutter this Olympic summer, here's what you need to know.

THE OUTLOOK Further volatility is a threat, with the Germans going to the polls in October. Ross comments: 'The German public is increasingly being swayed by the far- Right, which could achieve a mid-teen percentage vote share. 'A strong EU needs a stable political situation in France and Germany – and at the moment, this is certainly in question.

' However, he argues that the European markets are now being dominated by 'companies that are exposed to global structural trends not to domestic European politics'. Ross continues: 'These markets now have more semi-conductor exposure in the shape of the Dutch group ASML, which manufactures the machinery to make chips, and more global pharmaceutical companies, like Novo Nordisk, the Ozempic weight-loss drugs group.' RELATED ARTICLES Previous 1 Next Shares that can profit from Labour's election plans One in four younger investors now get investment ideas from.

.. Labour will boost UK shares, says BlackRock - and these.

.. How the rich are shielding their money from Labour: Tax.

.. Share this article Share HOW THIS IS MONEY CAN HELP How to choose the best (and cheapest) stocks and shares Isa and the right DIY investing account Henderson European Trust offers exposure to ASML, Novo Nordisk, German software group SAP and the French industrial automation company Schneider.

The trust's shares stand at an 8 per cent discount to its net asset value (NAV), suggesting it could be a bargain way to follow Europe's stars. Other best buy funds include Fidelity European. But if you are keen to back individual stocks, here are some shares that fund managers have in their sights.

STOCKS TO WATCH BEAUTY The brands owned by the €214billion (£180billion) beauty colossus L'Oreal range from high-end Aesop and Lancome to the cheap and cheerful Maybelline and Cerave, which is a hit among Generation Z. Nicolas Hieronimus, L'Oreal's chief executive, says this year's growth in the global market for these and other brands may be 4.5 to 5 per cent, rather than 5 per cent, as earlier forecast.

But this would be due not to France's summer of unrest, but to a slowdown in China. Shares are down by 8.4 per cent this year to €412.

60. But analysts are upbeat: the average target price is €450, but one optimist argues they could hit €526. ENTERTAINMENT Bollore Group, a €15.

5billion (£13billion) family-controlled French conglomerate is described by Joe Bauernfreund, manager of the AVI Global trust, as 'one of Europe's last byzantine corporate structures'. Read More Labour will boost UK shares, says BlackRock - and these funds could profit Among its varied shareholdings are Universal Music and Vivendi, owner of the Canal+ TV channel and the Havas advertising agency. Bauernfreund will be adding to the trust's stake in Bollore, arguing that 'political instability has provided an opportunity'.

LUXURY LVMH, the French giant behind such brands as Tiffany and Louis Vuitton, will be in the spotlight as a main sponsor of the Olympics. But its shares have fallen 16 per cent in a year, amid weakening demand for bags and baubles. This could be a good moment to take a closer look at L'Oreal, or so argues Gerrit Smit, manager of the Stonehage Fleming Global Best Ideas Equity fund.

He contends that this is not a domestic enterprise, but a truly global operator. Smit makes the same case for Essilor Luxottica, which is the worldwide leader in the glasses and sunglasses sector, thanks to its Oliver Peoples, Persol and Ray-Ban brands. TECHNOLOGY ASML shares have surged by more than 50 per cent to €1002 over the past 12 months propelled by excitement over generative AI (artificial intelligence).

But analysts are continuing to rate the company as a buy, with some analysts targeting a price of €1,302. Smit says that the €386billion (£324billion) group is set to be a beneficiary of the onshoring of semiconductor capacity to the West, and, specifically, to the US. DIY INVESTING PLATFORMS AJ Bell AJ Bell Easy investing and ready-made portfolios Learn More Learn More Hargreaves Lansdown Hargreaves Lansdown Free fund dealing and investment ideas Learn More Learn More interactive investor interactive investor Flat-fee investing from £4.

99 per month Learn More Learn More eToro eToro Share investing: 30+ million community Learn More Learn More Trading 212 Trading 212 Free share dealing and no account fee Learn More Learn More Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

Compare the best investing account for you Share or comment on this article: As political uncertainty drives their prices down...

Look to Europe for some star performers e-mail Add comment Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use.

We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence. More top stories.