Japan's stock markets recently experienced volatility amid political changes, with the Nikkei 225 and TOPIX indices registering declines as investors reacted to new leadership and monetary policy signals. Despite these fluctuations, the Japanese market remains a fertile ground for growth companies, particularly those with high insider ownership, which can align management interests with shareholder value—a crucial factor in navigating uncertain economic landscapes. Top 10 Growth Companies With High Insider Ownership In Japan Micronics Japan (TSE:6871) 15.

3% 31.5% Hottolink (TSE:3680) 26.1% 61.

5% Kasumigaseki CapitalLtd (TSE:3498) 34.7% 38.5% Medley (TSE:4480) 34% 30.

4% Inforich (TSE:9338) 19.1% 29.5% Kanamic NetworkLTD (TSE:3939) 25% 28.

3% ExaWizards (TSE:4259) 22% 75.2% Money Forward (TSE:3994) 21.4% 68.

1% Loadstar Capital K.K (TSE:3482) 33.8% 24.

3% AeroEdge (TSE:7409) 10.7% 25.3% Underneath we present a selection of stocks filtered out by our screen.

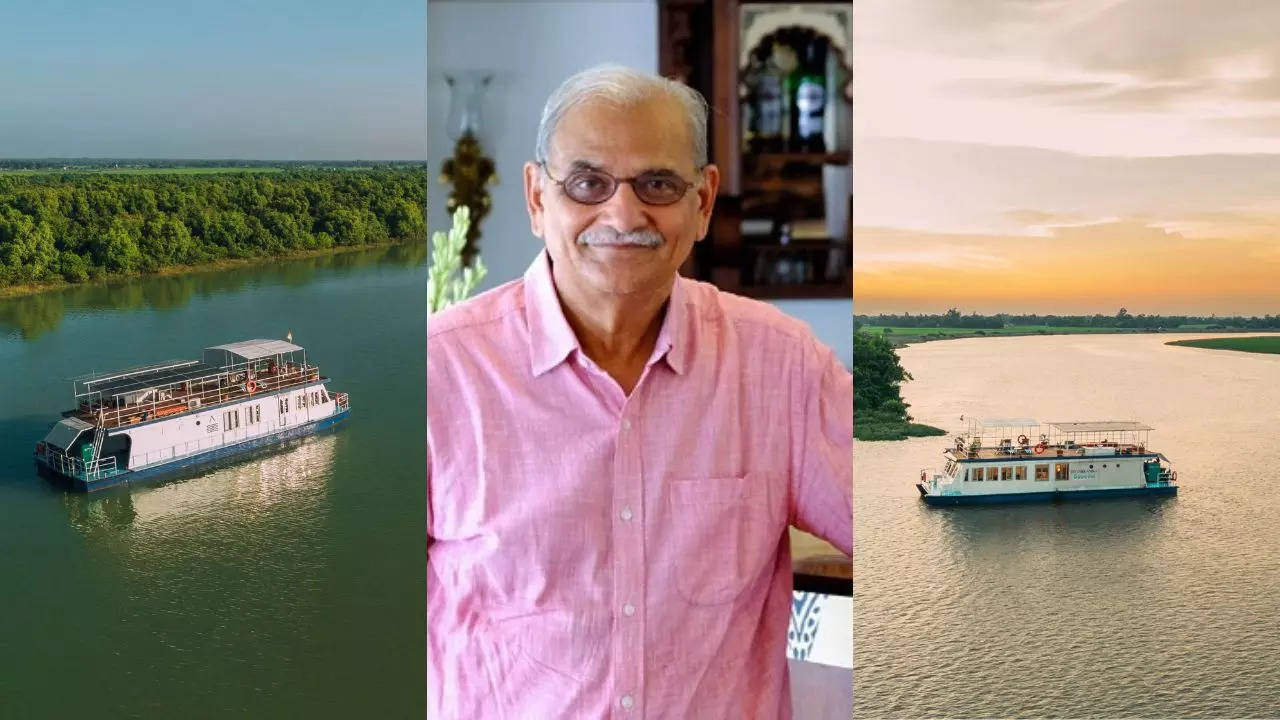

★★★★★★ Kasumigaseki Capital Co., Ltd. operates in the real estate consulting sector in Japan and has a market cap of ¥183.

49 billion. Kasumigaseki Capital Co., Ltd.

's revenue segments include real estate consulting services in Japan. 34.7% 38.

5% p.a. Kasumigaseki Capital Ltd.

is poised for significant growth, with earnings forecasted to expand 38.54% annually, outpacing the Japanese market's average. Despite a volatile share price and past shareholder dilution, its revenue is projected to grow at 26.

3% per year, .