Stating the obvious, equity markets are roiled by frequently changing “tariff” headlines. The Economic Policy Uncertainty Index has spiked to its highest levels since global governments shut down the economy during the COVID-19 pandemic.That uncertainty has pushed the S&P 500 into correction territory with a 10 percent decline, triggering news headlines about a possible recession.

Further instigating investors’ concerns is that members of the White House have not ruled out economic pain. I may be naïve in trying to predict fiscal policy in this uncertain world, but it appears the White House is starting to walk back statements like there will be “pain ahead,” which previously suggested they would accept a recession as they levy tariffs.It would be particularly helpful to know whether investors have sufficiently deleveraged so that equity markets are near a sustained bottom.

Investor sentiment is terrible, and that is a bullish signal for a contrarian investor like me. However, erratic policymaking can add to those extremes by making pessimistic investors even more fearful, so I do not rule out further downside. From 1950 to 2024, the average intra-year market drop was 13.

6 percent (the average annual return was 11.6 percent). My best guess is that stock will bottom out in mid-2025, down between 16 percent and 20 percent.

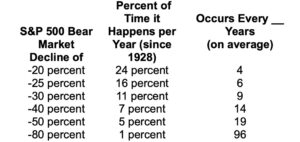

Why do I think the S&P’s downside limit is “only” 20 percent? In two words, “no recession.” The odds of a recession have doubled since t.